Understanding the difference between these two types of risk should change how you approach customer research.

Consider two companies tackling very different problems:

- The first, WoolyCo, is inventing a cure for baldness

- The other, Vector & Mask, is creating a prototyping tool for designers

WoolyCo, obviously has a market. It should be fairly obvious that they don’t need to spend any time doing customer interviews to validate the problem. They aren’t going to hear anything that isn’t already well understood. The questions they face are figuring out if it’s actually possible and if it is, how are they going to divide up the billions of dollars they’re going to print on a daily basis.

Vector & Mask, on the other hand, don’t have to wonder if creating a desktop application with the ability to create, manipulate, and share design assets is possible. It definitely is. Their existential question is, “Are people going to be willing to use this instead of Sketch, Figma, or whatever Adobe is pushing these days?”

WoolyCo have a Product Risk. Can the product exist? Can this invention actually happen?

Vector & Mask have a Market Risk. Is there a market for this thing that we’ve built / are building?

Both are challenging in their own way.

Now, imagine having both of those problems.

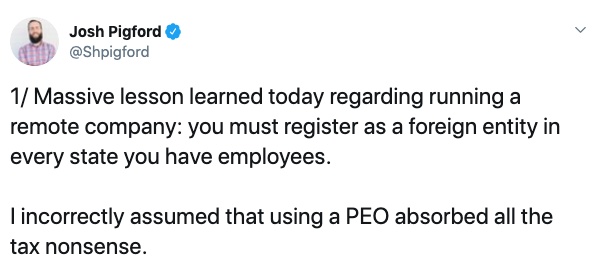

A thread by Josh Pigford of Baremetrics had me thinking about that this recently.

A PEO is a Professional Employer Organization and they help small businesses with a lot of HR-related issues, including federal payroll taxes but not state and local taxes.

Unfortunately for Josh, he’s going to be writing some pretty big checks.Some of the comments and conversations around this thread, of course, lead to some suggestions that there’s a SaaS opportunity here.

And there probably is because remote-first companies aren’t going away any time soon. In fact, that’s where the puck is headed and many savvy entrepreneurs are already skating there.

But there are two risks here:

Product Risk: Is it possible to build a SaaS product that can navigate the federal, state, and local tax codes around the world at scale?

Market Risk: Will businesses trust a software tool to manage that burden or will they stick with the existing, conventional solutions?

There’s definitely a white-glove, services-model approach to solve the first risk. The PEO who already has Baremetrics’ business could explore adding that level of management as an add-on service.

That’s not the Product Risk.

It’s whether or not it can be automated and scaled as a software tool. Tax laws are constantly changing, and remote companies hire employees around the world. The implications and complexity multipliers there are massive.

And then there’s the question of Market Risk. Will there be enough companies willing to hire this tool and trust it with such a specialized, notoriously arcane domain as taxes? Or, will they prefer to tack on services with their PEO, or make an additional administrative hire to own and solve the problem internally?

You may have a different interpretation on the degree of each of those risks and I’m not saying that either or both are unsolvable.

What’s important is having an honest understanding of the type of risk you face and how you can address it.

Product Risks cannot be addressed with market research. Market Risks cannot be addressed with engineering.

Ask yourself:

- Are we a “Product Risk” company?

- Are we a “Market Risk” company?

- Hoo boy. Are we both?

Getting the answer to these questions should change how you’re doing customer research.

If you’re a Product Risk company and you’re investing in customer research, pull back and focus on proving to yourself whether or not your idea can even exist.

If you’re a Market Risk company and you’ve got a giant engineering team and very little marketing and customer research expertise, rebalance your efforts to be sure that you aren’t fooling yourself. “If you build it, they will come” is one of the greatest movie scenes of all time, but it’s rarely true in business.