Do you find yourself in a market with a long-standing, dominant player, and you’re wondering:

“Are these folks susceptible to disruption?”

Or, maybe you’re trying to get a handle on what all this disruptive innovation talk is even about.

What is disruptive innovation and what is just good old fashioned and perfectly noble “somewhat better than the thing we had before?”

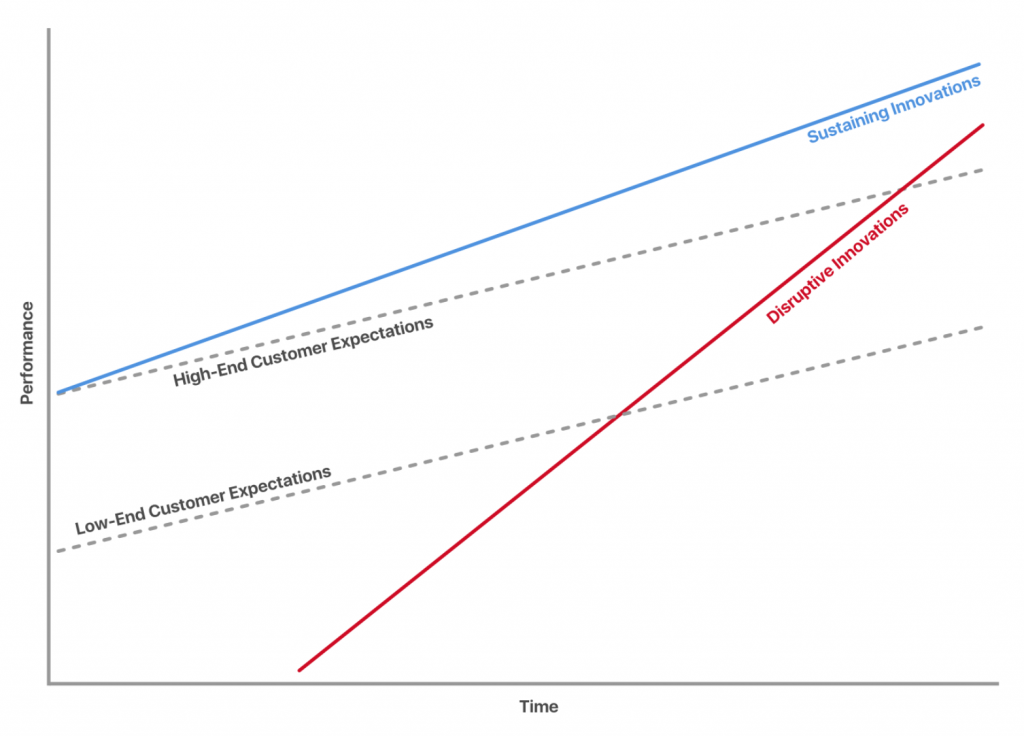

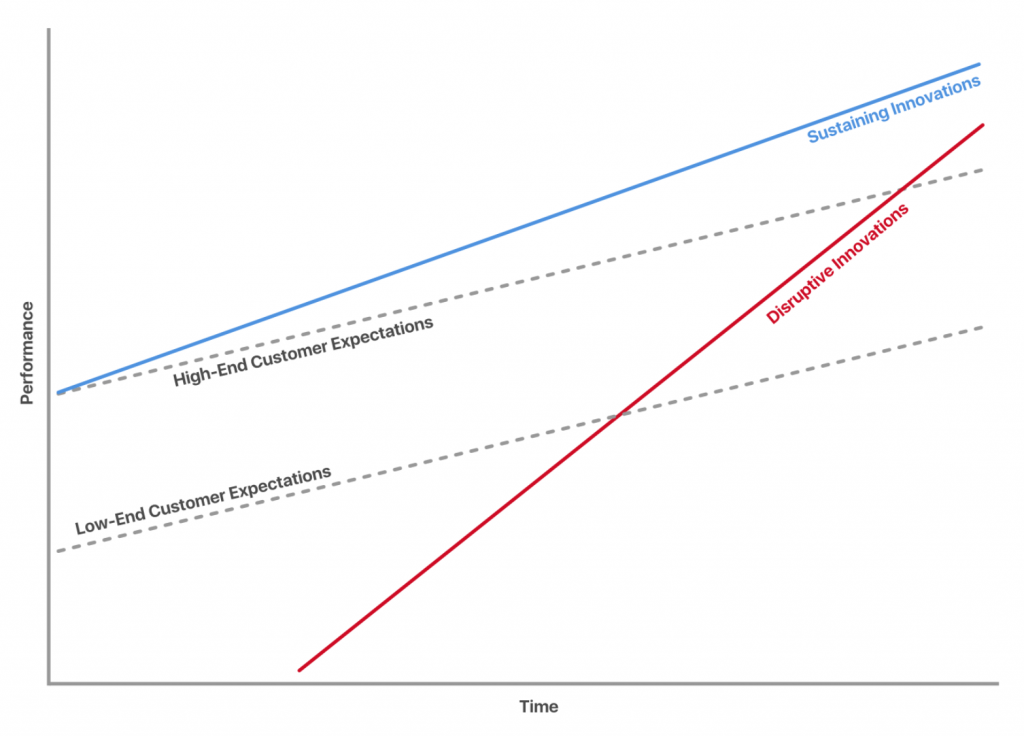

There are two types of innovations: sustaining innovations and disruptive innovations. “Sustaining Innovations” by another name might be described as “Feature Creep.”

Company designs a thing. Releases the thing. Customers love the thing.

Mostly.

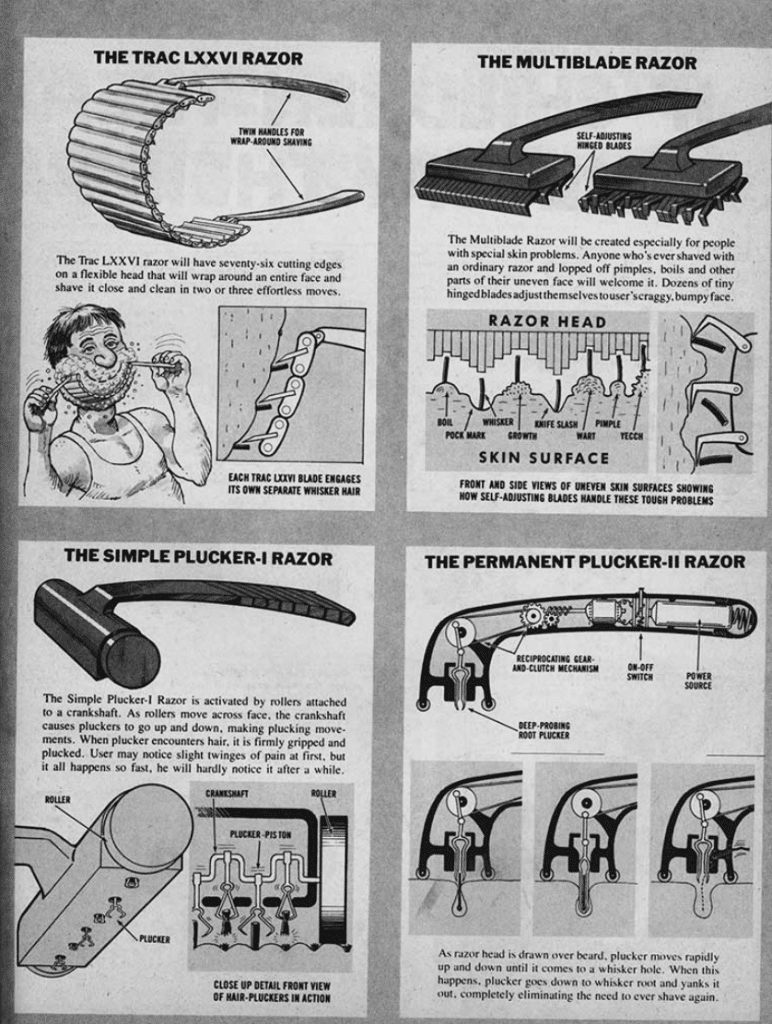

Then there are inevitable feature requests and well-paid VPs who need something to show for their year! So, they tack on a feature here, a doo-dad there, and before you know it you’ve got a five-bladed whisker removal device with a pivoting head, lubrication strip, and “microfins” to gently stretch your skin as you shave.

It isn’t that any one of those improvements was a bad thing. It’s just that it may not be entirely necessary or even noticed by the customer.

Interestingly, Mad Magazine predicted and poked a little fun at the over-implementation of shave tech back in 1979.

Anyway, those little additions are sustaining innovations moving the blue line a bit up and to the right as time moves along.

But then, something interesting happens. Someone comes along and captures market share, not by one-upping the dominant players, not by outdoing everyone else, but by under-doing the competition.

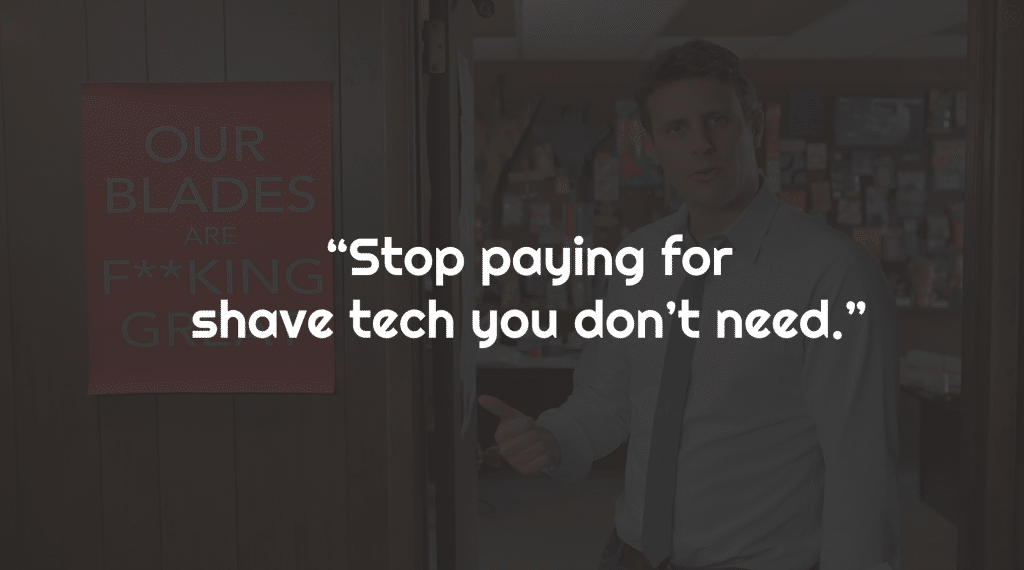

When Dollar Shave Club burst onto the scene, they didn’t say, “YO! SIX BLADES!”

Just the opposite in fact:

In what was one of the best marketing videos of its time and with some of the most memorable ad copy you can imagine, they said, “Stop paying for shave tech you don’t need.”

DSC’s contrarian and disruptive approach said:

- You don’t need all those freakin’ bells and whistles.

- The big guys are over-charging you.

- For a couple bucks, we’ll ship your much simpler, but perfectly acceptable two-bladed razors to your door.

Dollar Shave Club is the red line, finding product-market fit with functionality well below what the incumbents are offering.

If you’re the little guy and you’re looking up at a dominant competitor, ask yourself:

“What are my competitors over-doing? What did they add to their flagship offering that they pitched as a monumental breakthrough, but their customers barely noticed?”

As the big guys start to see diminishing returns with each new product release and if their once elegant and simple offering is starting to resemble Microsoft Word’s menu bar … they might be ripe for disruption.

In another post, I describe the process for figuring outwhich of your customers’ needs are under-served.Need a Stellar Jobs to Be Done Survey? Here’s How to Create One!Learn to design a JTBD survey, download a JTBD survey template, and prioritize your product roadmap effectively. Discover how to utilize the Jobs to Be Done approach for understanding customer needs with our step-by-step guide.

To discover if a disruptive strategy would work in your market, look for the opposite of what I describe in that post:

- Interview your competitors’ customers.

- Discover if there are outcomes that are less important and over-satisfied.

- A large number of unimportant outcomes that are highly satisfied suggests an over-served market.

If you’re able to, meet those same needs at a lower cost with less features, less promises, and less complexity to win customers over-paying for tech they don’t need.